“Stonks only go up”, “To the moon”, “Hodl” — if you’ve been following the rise of crypto and meme stocks, you’ve likely encountered at least one of these mantras. While these phrases may seem like mere internet humour, historical financial data actually lends credence to the notion that, over the long haul, the stock market seems to “only go-up”. In this article, we’ll delve into the underlying mechanics that drive the market’s upward trajectory over the long run.

What is Macro?

A Macro investment strategy is a “big picture” strategy that focuses on interpreting broad macro-economic trends to make investment decisions. By analysing factors like economic growth, inflation, and interest rates, macro investors try to predict how these forces will affect markets and asset prices. In this article, we will focus specifically on economic growth and its impact on stock prices.

What drives stock prices?

I am going to make the bold statement that the biggest driver of stock prices is economic growth.

Let’s think about it logically:

During an economic boom, employment levels are high and consumer confidence increases. People feel optimistic about the future and as a result, they increase their spending – particularly on discretionary and luxury goods. This boost in consumer demand leads to stronger business performance, driving up company earnings (profits) and subsequently, stock prices. Rational investors invest in companies that are expected to perform well in the foreseeable future and produce good returns for shareholders. Therefore, if businesses are expected to perform well in the future, there will be greater demand for their shares. Ultimately, it doesn’t matter how innovative a company is or how good the management is, it can’t succeed if no one buys its products.

One important thing to know about financial markets is that they are forward looking, this means they don’t respond to what is happening now, but to future expectations. This is why a stock market decline begins well before a recession starts and the market begins to tick higher before a recession ends.

Short-run vs. Long-run Economic growth

There are two types of economic growth: Short-run and Long-run economic growth.

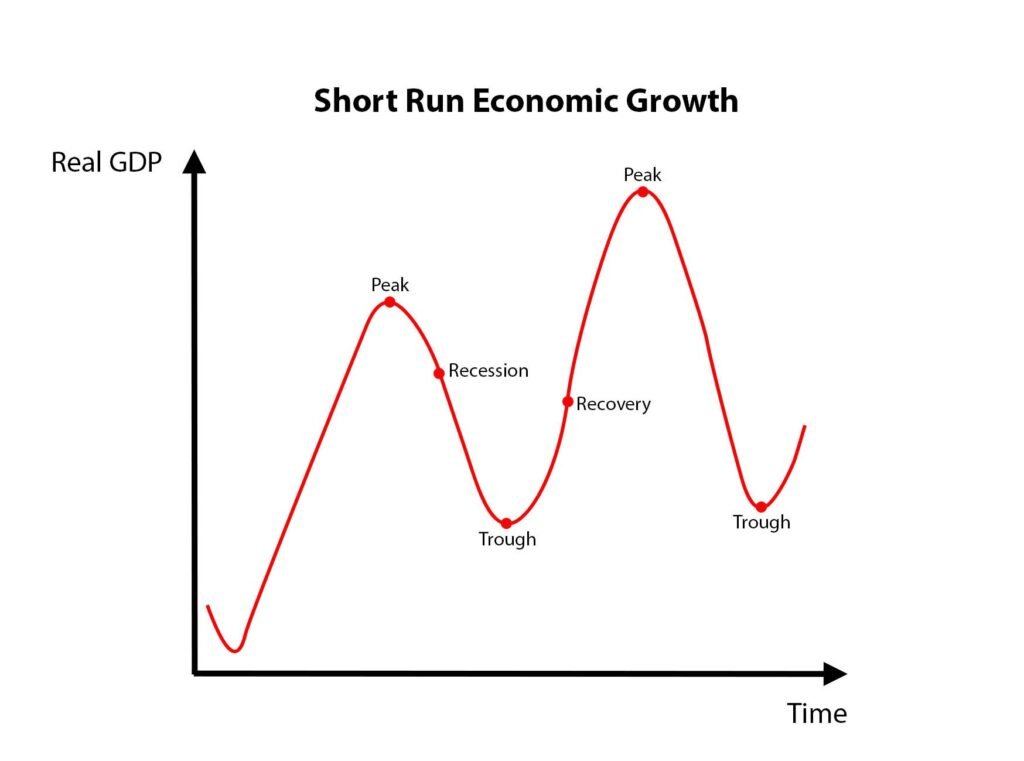

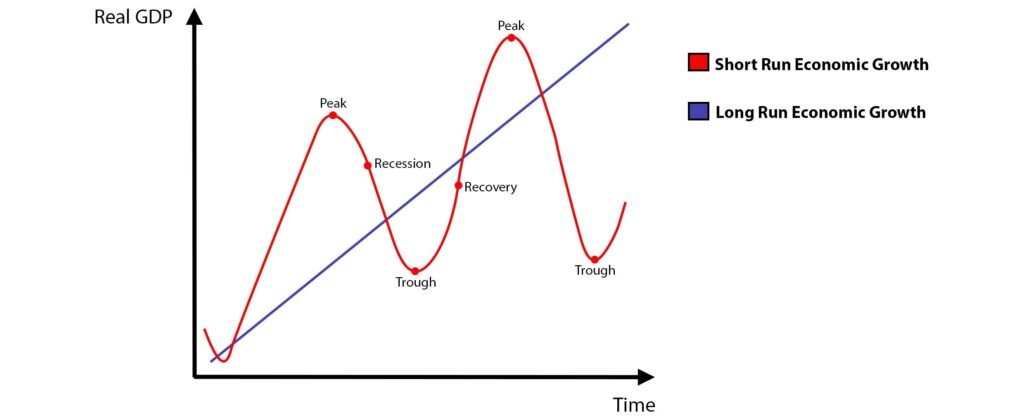

Short-run economic growth looks something like this:

This is also known as a business or economic cycle. We have a peak, which represent an economic boom and a trough which represent a period of economic decline.

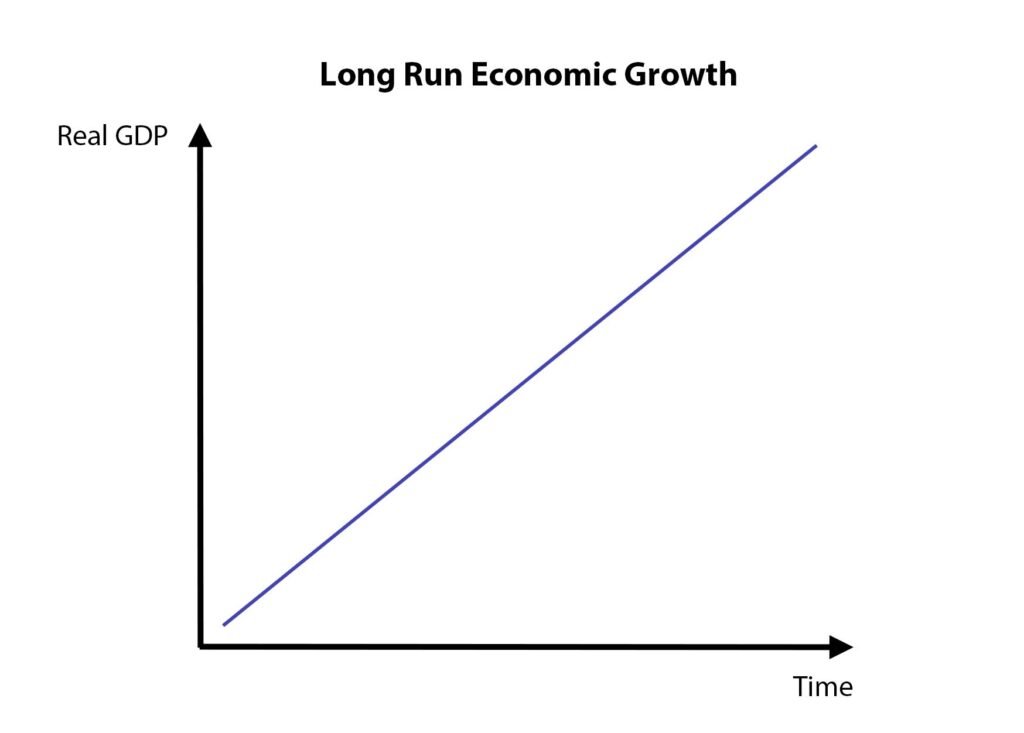

Long-run economic growth looks something like this:

Developed economies have a long run growth trend of about 2% a year; this means in the long-run, the economy trends upwards.

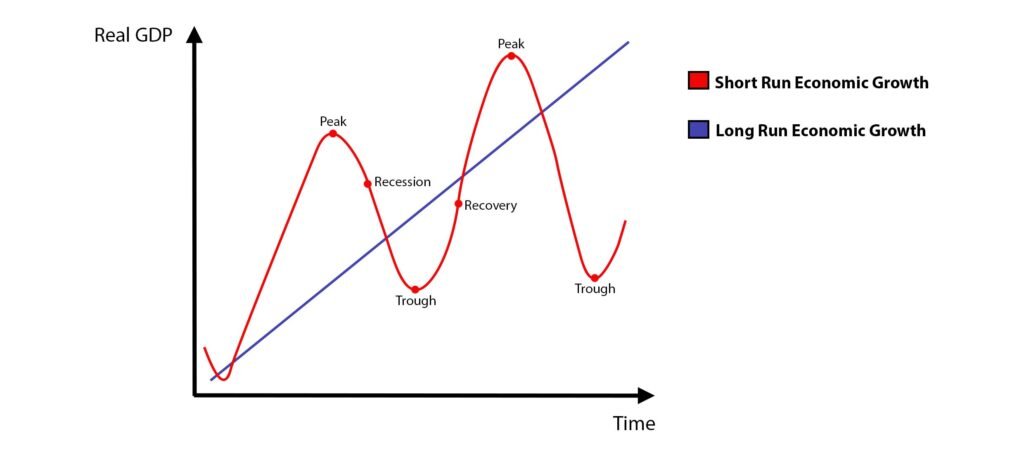

Here’s what short-run and long-run economic growth put together looks like

In the short-run, the economy has booms and busts, however, in the long-run, the economy trends upwards, at a rate of about 2% a year in the US.

Now, this is where things get really interesting…

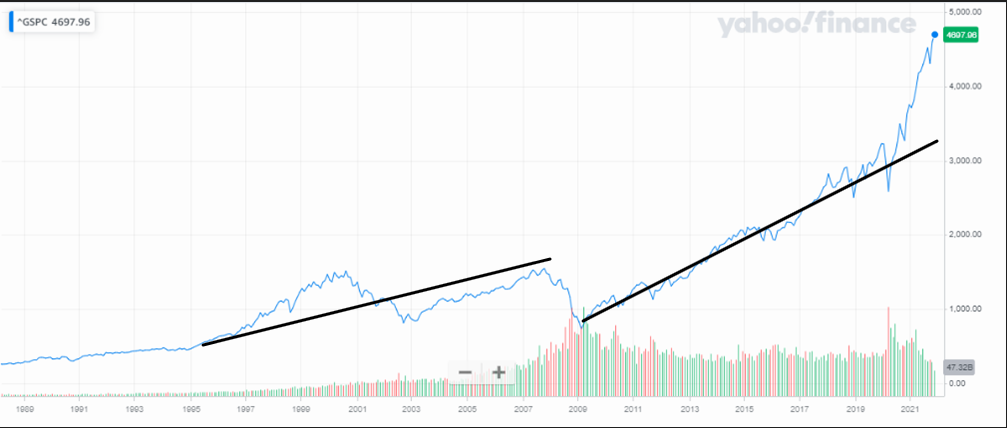

The graph above of long-run and short-run economic growth put together looks a lot like the S&P 500’s performance over time.

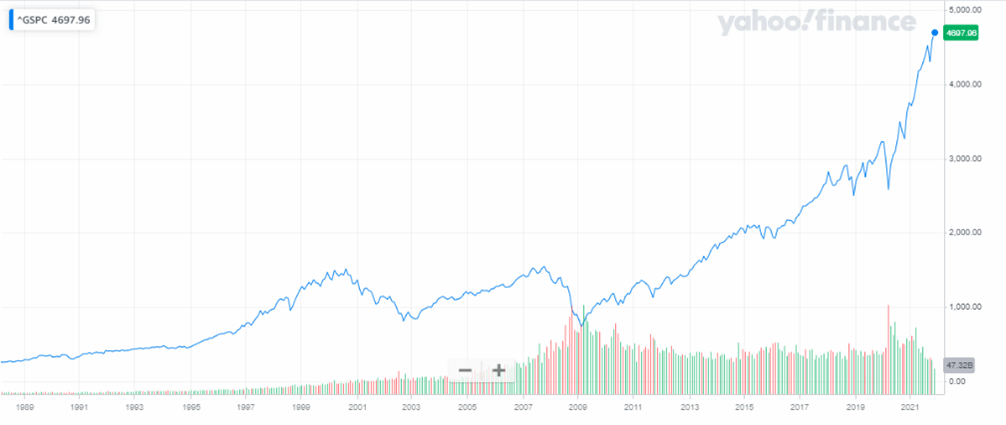

In the short run – the S&P 500 has peaks and troughs (booms and busts) but in the long run it seems to only go up.

Now, if we were to insert the long-run economic growth trend line, we would get something very similar to how the economy evolves over time. Therefore, if you invest in the S&P 500 over a long period of time, the probabilities of making money are in your favour.

Here are the two graphs:

The first graph shows short run and long run economic growth and the second graph shows the S&P 500’s performance since 1989. If we insert the long run economic growth trend on the S&P 500, we can see the stock market’s performance is very similar to how the economy evolves over time.

To conclude

The stock market follows economic growth in both the short-run and the long-run; but a more precise definition would be – the stock market moves ahead of the economy. This is because financial markets are forward-looking i.e they react to future expectations in the present. If you really want to succeed as an investor, you must live in the future. If you can accurately predict where the economy is going to be in the next 6 – 12 months, you can make a fortune. This is because certain sectors perform better in good economic conditions, so you can take a long position in them. When the economy slows down, you can take a short position in sectors that will be adversely affected such as luxury products stocks, better known as consumer discretionary stocks. In times of recessions, rational individuals won’t be queuing up to buy Tesla’s or Gucci bags.

Everything explained in plain English

The stock market goes up in the long run because the economy grows in the long-run. In the short run, the economy has booms and recessions but in the long run it “only” goes up. The stock market derives its value from the economy, i.e. it is a derivative of the economy. If you think about it logically, the S&P 500 comprises of 500 large companies in the US, and businesses make up a big chunk of the economy – they provide jobs, pay taxes, provide services, invest etc. So by investing in the S&P 500, you are essentially betting on the US economy to perform well over time.

Disclaimer: The information contained in this article is purely educational and does not constitute as investment advice. Any commentary provided is the personal opinion and philosophy of the author. It is not intended nor should be considered as invitation or inducement to buy or sell any securities noted within. Investing and trading carry significant risk, please contact a financial professional before making any investment decisions.