It feels like everything gets more expensive year after year – food, rent, bills and transport; the only thing that doesn’t seem to go up is wages. In this article, we’ll discuss the importance of asset ownership because one other thing that also goes up over time is asset prices.

What is an Asset?

An asset is something that has the potential to increase in value over time or something that generates income.

Examples include:

Financial assets e.g. ETFs, stocks, bonds.

Real assets e.g. precious metals (gold, silver), land, property, commodities.

Intangible assets e.g. trade marks, patents, intellectual property.

However, in this article, we will only focus on financial assets.

Financial Assets

My goal is to provide you with practical knowledge that you can apply in real life, so we shall look at two examples of financial assets that you can invest in: the S&P 500 and the Dow Jones Industrial Average.

The S&P 500

The S&P 500 is a stock market index that tracks 500 of the leading publicly traded companies in the U.S. It includes household names like Apple, Microsoft, Amazon, Coca-Cola, Meta, Netflix, Nvidia, Walmart, and many more. Think of it as a pre-built, diversified portfolio of major U.S. businesses, carefully selected and maintained by S&P Dow Jones Indices.

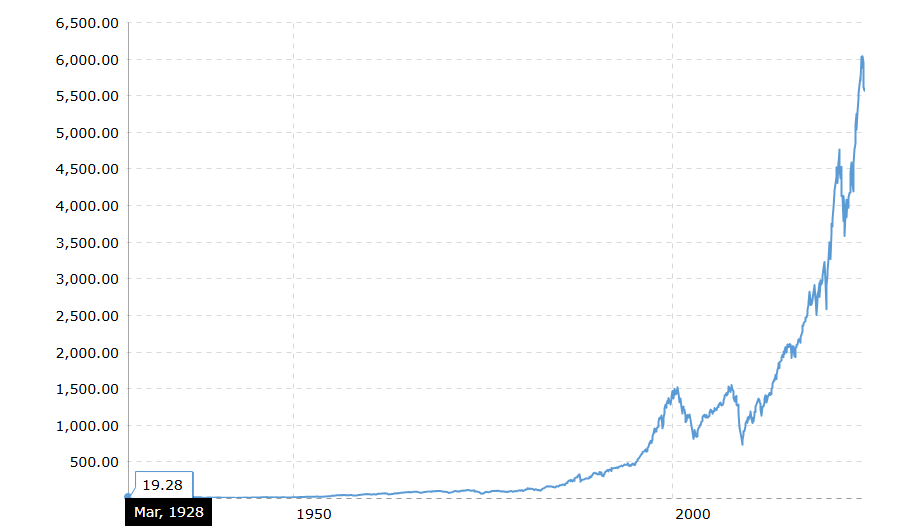

The S&P 500

The chart above shows the S&P 500’s performance dating back to 1928. While it officially became the S&P 500 in 1957, data has been reconstructed to show earlier trends.

Many people are sceptical of investing in the stock market, but when you look at the historical performance of the S&P 500, especially over 15-20+ year periods, the trend has been one of strong growth. All assets fluctuate in value – even the housing market, but this volatility is the price of long-term returns.

One popular strategy is to invest monthly into the S&P 500, allocating something like 10–20% of your income. This approach is called dollar-cost averaging and it helps smooth out the impact of short-term market swings. Even when the market takes a downturn, just keep investing. Investing in the S&P 500 is analogous to investing in the U.S. economy – the largest and most influential economy in the world. If you would like to read more on this, see the following article: Macro 101: Why stocks go up in the long run.

The Dow Jones

Another financial asset you can add to your asset portfolio is the Dow Jones Industrial Average. It is also a U.S. stock market index and it’s made up of 30 of the most prominent and influential companies in the U.S. These are industry leaders and household names like Apple, Nike, IBM, J.P. Morgan, Microsoft, Coca Cola, etc. Companies are selected for inclusion in the Dow based on their reputation, consistent earnings, and stock price, with the goal of reflecting the health of the broader U.S. economy. The result is an index filled with financially strong, relatively stable businesses that are considered the bedrock of American industry

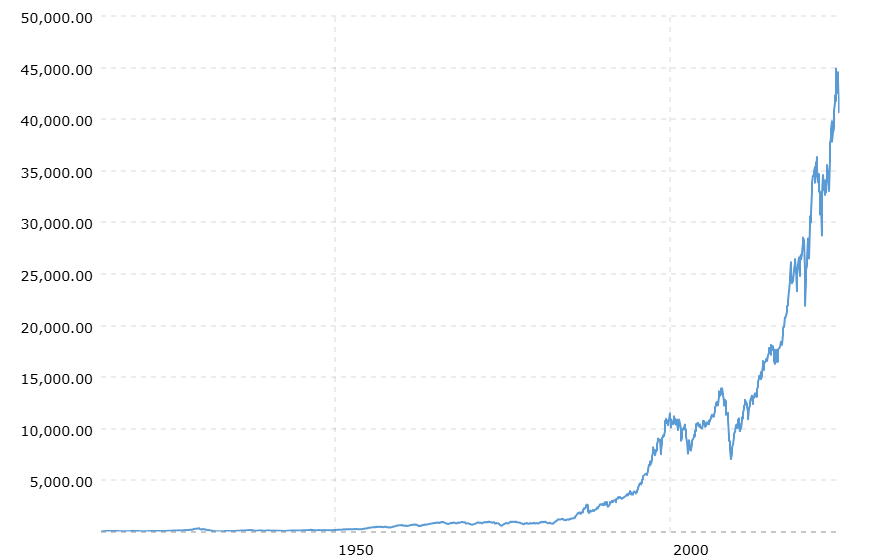

The Dow since 1896

Since its inception in 1896, the Dow Jones Industrial Average has experienced substantial growth. Starting at approximately $40.94, the Dow has risen to around $41,000 as of May 2025. This represents a cumulative return of approximately 100,046% over the 129-year period. This growth doesn’t include dividends, which would make total returns even higher.

If you would like to invest in the Dow Jones or S&P 500, you would need to do it through an ETF as you can’t directly own an Index.

Can you buy individual companies?

Yes, you can buy individual stocks but whether you should depends on your risk tolerance and investing strategy.

Picking individual stocks has the potential for higher returns. If you get it right, you can win big, think investing in Apple or Nvidia 10 or 20 years ago. There are cases of people who have become millionaires from these stocks with investments as little as $20,000.

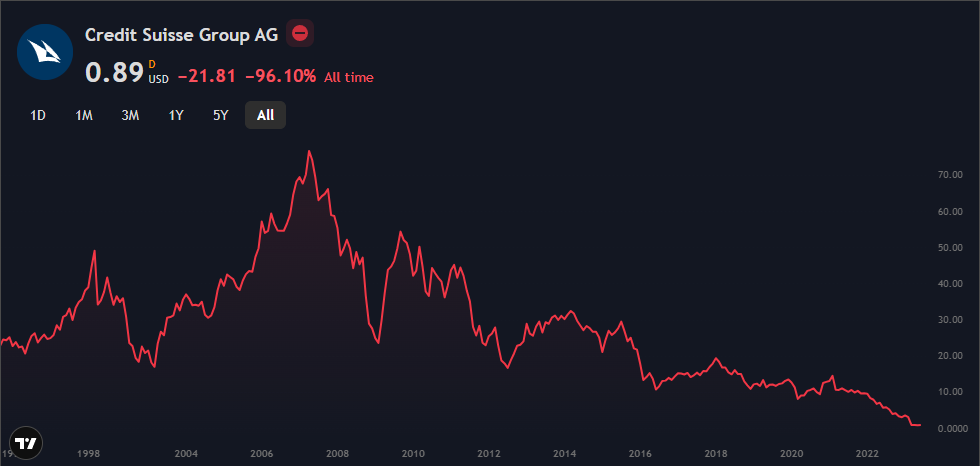

On the flip side, the risk is significantly higher. Companies can fail or underperform, take Credit Suisse, for example, which collapsed after decades of operation. Even a small portfolio of individual stocks can suffer if one or two positions drop sharply.

A lot people underestimate how difficult stock picking really is. That’s why for many investors, especially beginners, it’s often more prudent to invest in a diversified index like the S&P 500. It spreads your risk across hundreds of companies and has historically delivered strong returns over the long term. It also requires significantly less time, research and expertise than picking individual stocks.

The Rise and Fall of Credit Suisse

Final thoughts…

Many people focus on increasing their salary as a means to becoming wealthy, but I say to you, aim to increase your asset ownership. If you can consistently invest 10-20% of your income into assets such as the S&P 500 or the Dow Jones each month, over time your wealth can grow significantly.

These investments can form a strong foundation for your financial future. While salary may stop if you lose your job, your assets can continue working for you and generate returns. In some cases, investors use the returns from these assets to acquire other wealth-building tools like land or property.

In some years, the S&P 500 has delivered returns of over 30%, and with the power of compound interest, even modest contributions can turn into substantial wealth over time.

In the next article, we’ll dive into the power of compounding and how it transforms consistent investing into generational wealth.

– Adonis

Disclaimer: The information contained in this article is purely educational and does not constitute as investment advice. Any commentary provided is the personal opinion and philosophy of the author. It is not intended nor should be considered as invitation or inducement to buy or sell any securities noted within. Investing and trading carry significant risk, please contact a financial professional before making any investment decisions.