In this article, we will explore the difference between passive and active investing.

Here is a simple explanation to get us started:

Passive investing – buying a basket of already selected securities (can be stocks, bonds, commodities) in the form of an index or ETF. With passive investing, you do not choose individual stocks yourself, so there is no individual analysis of stocks needed.

A security is a tradable financial asset

Active investing – constructing your own basket of securities with the aim of out-performing the market. This involves doing your own individual research, analysing balance sheets, economic outlook etc.

Passive Investing

Recall in the second article we briefly discussed about indices; I will not ask you to go back and read so here is a mini refresher:

A standard definition of an index is “a benchmark or measure of something”. The S&P 500 is an example of a stock market index. It measures the performance of the 500 largest companies in the United States, so the average of that gives us a pretty good proxy of how the stock market as a whole is performing. The S&P 500 is also typically referred to as the “market”.

Historically, the market (S&P 500) has typically given an average return of about 8 – 10% a year. This is just the average; in some years it is considerably higher and in some periods during bear markets it can even be negative.

Buying the Market

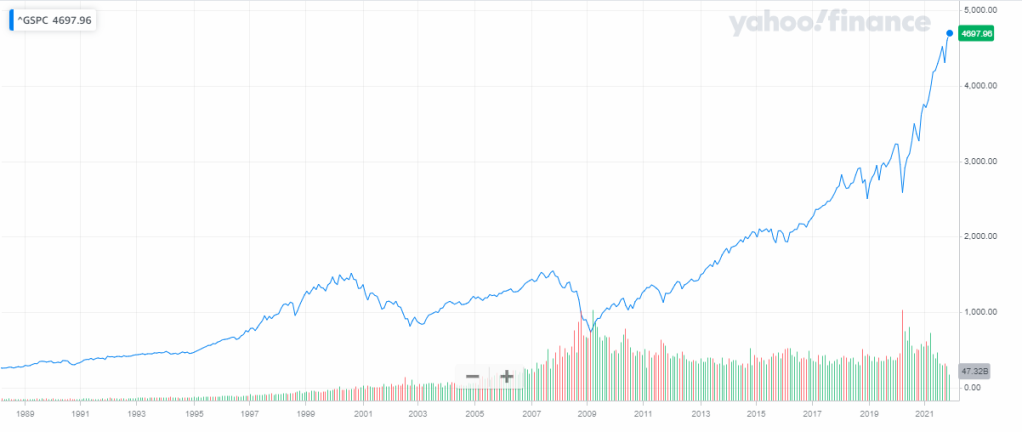

So, with a passive investing strategy, you can simply buy the whole market (S&P 500) and accept whatever return it gives you. By buying the market, you are essentially buying a small fraction or piece of 500 companies all at once. This helps with diversification as you are gaining exposure to 11 sectors, 126 industries, 500 companies all at once. The result of this is shown on the chart below.

The chart shows the performance of the S&P 500 since 1989. Although there are some dips and periods of decline, the general long-run trend of the market is upwards. The periods of decline are notably the 2000 dotcom bubble burst, The 2007-08 housing market crash and recently the Covid-19 pandemic.

Dollar Cost Averaging

This is a strategy that involves purchasing a security periodically, as opposed to a lump sum investment. For example, you could invest $100 each month or however amount that suits your financial goals.

No one knows with certainty where the market is going to be tomorrow, so with dollar cost averaging you do not need to attempt to time the market.

Dollar cost averaging works particularly well with the S&P 500 because we know the long-run trend is upwards, so even during a correction or dip, you can still buy. If you want to be a bit aggressive you can increase your purchases during a correction or dip because you know the long-run trend is upwards, think of it as buying at a discount.

In a separate article, I will explain the mechanics behind the S&P 500’s long-run upward trajectory, it has to do with the fact that company earnings are a derivative of economic growth.

I used the S&P 500 as an example, but you can also passively invest in other broad indices such as the Dow Jones (US), FTSE 100 (UK), DAX (Germany), Nifty 50 (India) etc.

ETFs

ETFs, known as Exchange Traded Funds, give you exposure to a specific index, sector, industry or commodity. The S&P 500 is not a directly tradeable asset, so you would need an S&P 500 ETF. Retail brokers like Trading 212 have it listed as “Vanguard S&P 500 ETF”.

Active Investing

Now that we understand passive investing, it will be easier to gain an appreciation of active investing.

Active investing involves selecting your own securities and building your own portfolio. You would need to do deep dive research into companies, correct sector positioning, good risk-management etc. When you are actively investing, it means you want a return that is greater than what the market gives, in other words you are trying to “out-perform” the market.

Active investing offers the potential for greater returns than what the market gives, keyword here being potential. Therefore, if done correctly you can potentially make larger gains, but you can also make a real mess out of it and end up donating your money to the market. Unless you spend a considerable amount of time doing stock selection and equity research, it is advisable to just buy the market and play the long game.

Over a quarter or two or maybe even a year you may out-perform the market, but over a 5–10-year horizon, this may not be the case. Many professional investors and hedge funds fail to out-perform the market over a long-time horizon.

If you have an actively managed portfolio, it is a good idea to compare your returns to the S&P 500 and see how you fare.

That is all from me, in the next article we will explore why the market trends upwards in the long run

– Adonis

Leave a comment