Intro

We live in a debt-driven economy, almost everyone has some form of debt – student loans, car loans, mortgages, credit cards. Consumer spending accounts for roughly 70% of U.S. GDP and a significant portion of that spending is financed by borrowing. So who benefits the most from this system? It’s the lenders and creditors. In this article, we’ll explore how you can also become a creditor and profit from the debt-driven economy.

What is a debt-driven economy?

A debt-driven economy is a system where economic growth is fuelled by borrowing. Instead of people and businesses spending only what they have, they take out loans to buy homes, cars, appliances, etc. Companies also borrow to expand, and governments borrow to fund programs and projects. This isn’t necessarily a bad thing, it’s just how modern economies work and this borrowing actually helps the economy to grow.

When a bank approves a mortgage, a family moves into a new house and this will trigger a ripple effect. Construction workers get paid, furniture stores make sales and appliance manufacturers ship products. One loan creates economic activity that impacts dozens of industries and thousands of jobs.

Who benefits in a debt-driven economy?

So who actually benefits from all this borrowing?

The short answer: anyone who lends money or facilitates lending.

Here are the main winners:

Banks and Financial Institutions

Banks are the most obvious beneficiaries. When you take out a mortgage, car loan, or use a credit card, banks earn interest on that debt. The more people borrow, the more money banks make. Major players like J.P. Morgan Chase, Bank of America, and Wells Fargo have built empires on this model.

Credit Card Companies

Companies like Visa, Mastercard, and American Express profit every time you swipe your card. They earn fees from merchants and, in some cases, interest from cardholders who carry balances. With consumer spending heavily reliant on credit, these companies enjoy a steady stream of revenue.

Consumer Lenders

These are companies that specialise in personal loans, auto loans, and other forms of consumer credit. Names like Capital One, Discover, and SoFi fall into this category. They earn money from the interest borrowers pay over time.

To put this in perspective, let’s look at Capital One Financial – one of the largest credit card issuers in the United States.

Here are the numbers for 2025:

Total Revenue: $53.4 billion

Profit: $2.5 billion

Much of this profit comes directly from interest charged on credit cards and consumer loans. That’s the power of being a creditor in a debt-driven economy.

How you can benefit

Now that you understand who profits from a debt-driven economy, the natural question is, how can you get in on it? The good news is you don’t need to start your own bank (you could if you wanted to). But a much more simpler route is to buy shares in the companies that profit from lending. When you own stock in a bank like J.P. Morgan Chase, a credit card company like Capital One, or a payment network like Visa, you become a part-owner of that business. By doing this, you’ll essentially be positioning yourself on the creditor side of the economy and this my friends, is the beauty of the stock market – you can buy ownership in already established and profitable businesses.

When you invest in lending companies, your wealth can grow in two main ways: Stock price appreciation and dividends.

Stock price appreciation

As these companies collect interest payments and grow their profits, their stock prices tend to rise over time. When you buy shares at one price and the stock increases in value, you can sell those shares later for a profit. For example, if you buy shares in Capital One at $100 and the stock rises to $130, you’ve gained 30% on your investment, without doing anything except holding the stock.

Dividends

Many financial companies pay dividends – regular cash payments to shareholders. This is essentially a share of the company’s profits sent directly to you. Banks like JPMorgan Chase and Wells Fargo, for instance, have long histories of paying quarterly dividends. This means you can earn passive income simply by owning their stock. You can pocket this cash or reinvest it to buy more shares, which accelerates your wealth-building over time.

The combination of rising stock prices and steady dividend income creates a powerful compounding effect. The longer you stay invested, the more your money can grow.

Stock Performance of Lenders:

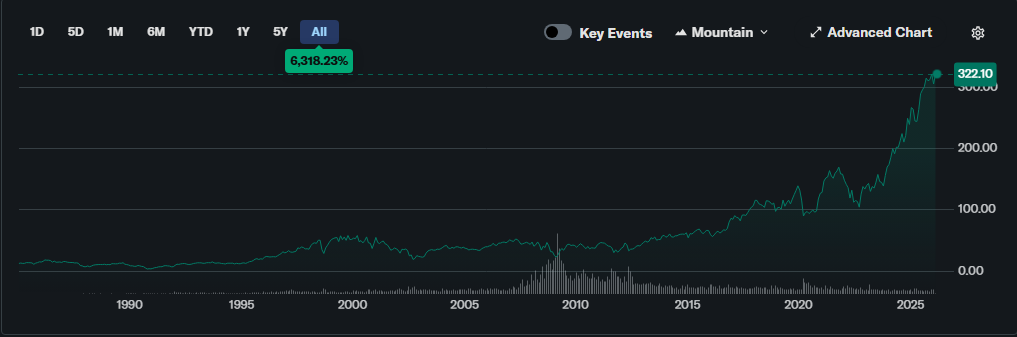

J.P. Morgan

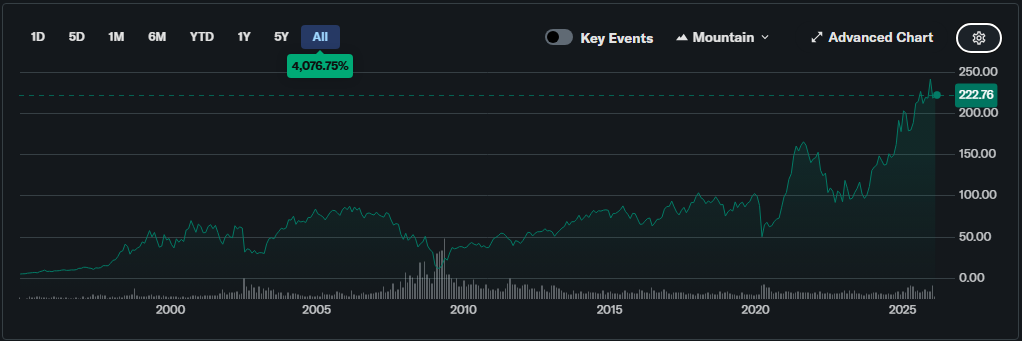

Capital One Financial

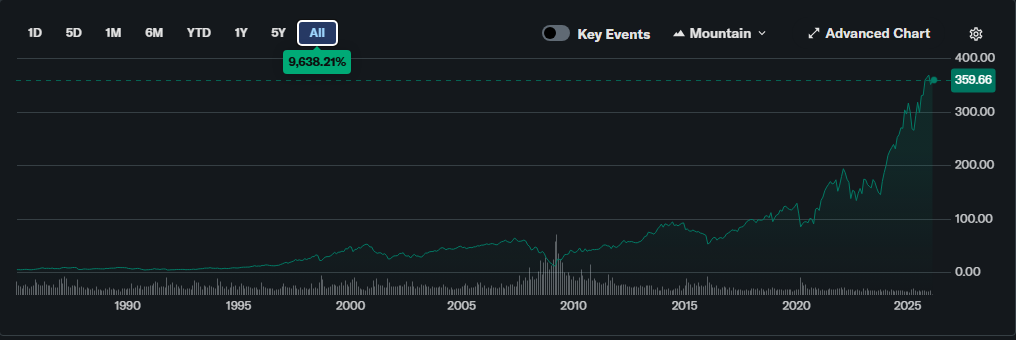

American Express Company

Caveats

No investment is risk-free and lenders are no exception. Here are the key risks to keep in mind:

- Recessions hurt lenders: When the economy contracts, unemployment rises and borrowers struggle to repay loans. Defaults increase, profits shrink, and stock prices can fall significantly more than other stocks.

- Interest rate swings: Rising rates can boost lending profits but if rates climb too fast, borrowing slows and defaults may rise. Falling rates can squeeze profit margins.

- Borrowers may not pay: Lenders only make money when loans get repaid. Companies that lend to riskier borrowers face higher default rates, which can erode profits quickly.

- Regulation can tighten: Governments can impose new rules on lending practices, capital requirements, and interest rate limits. This can impact profitability.

Final thoughts…

The debt-driven economy isn’t a secret, it’s the system we all live in. Trillions of dollars in interest and loan repayments flow from borrowers to lenders every single year. Banks, credit card companies, and financial institutions profit from this cycle, day in and day out.

You’ve spent your life as a borrower, now you know how to become a creditor. The tools are accessible. The companies are publicly traded. It’s time to take control of your financial future.

Deuteronomy 28:12: …“You shall lend to many nations, but you shall not borrow”

– Adonis

Disclaimer: The information contained in this article is purely educational and does not constitute as investment advice. Any commentary provided is the personal opinion and philosophy of the author. It is not intended nor should be considered as invitation or inducement to buy or sell any securities noted within. Investing and trading carry significant risk, please contact a financial professional before making any investment decisions.